Ever wonder why there is such a gap between all the hard work you do in providing Voice of the Customer and Net Promoter Scores to your internal partners and then not being able to see how that in turn results in enabling the company to improve their financial or operationals? With a veritable wealth of verbatim, Moments of Truth, customer feedback, and a trove of response and sales/marketing data and in many cases a very positive NPS alas, those departments still have no true understanding of WHY this is all happening and the levers and triggers that created those data points.

Ever wonder why there is such a gap between all the hard work you do in providing Voice of the Customer and Net Promoter Scores to your internal partners and then not being able to see how that in turn results in enabling the company to improve their financial or operationals? With a veritable wealth of verbatim, Moments of Truth, customer feedback, and a trove of response and sales/marketing data and in many cases a very positive NPS alas, those departments still have no true understanding of WHY this is all happening and the levers and triggers that created those data points.

Maybe you are missing something?

We think that is absolutely the case. So many companies are only using VOC/NPS coupled together to use as a Customer Experience metric set. Throw in an occasional customer health check or even a slightly deeper peek asking some of their customers and employees how happy they are or at their campaign and UX data and that’s the extent of it.

Then when an Executive wheels by to ask how this directly affects ROI or where are the actionable steps based on negative surveys or NPS scores – crickets…

What if you could tie all of this hard work together and understand EXACTLY where things are going right – let’s do more of them – and wrong – let’s fix these.

That’s where longitudinal research (minding) and data layering (mining) comes in. Some people call up their six sigma black belts others their experience/journey mapping but all of these techniques and supporting tools essentially just take emotional and time or flow-based data and array them in a way to expose what, where and why Moments of Truth and Pain points are occurring in your relationship with your clients.

First – Minding!

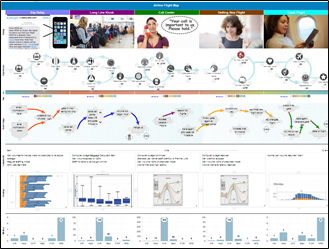

Consider documenting the Customer’s Experience (front stage) and the Customer Experience (backstage). You can do it touch by touch (log onto my account) or activity by activity (e.g. transfer funds). Then overlay your VoC/VoE and NPS. One thing you will notice immediately is that most of your insight/data is now collected at the end. Capturing comments and scores AFTER the whole transactional element or relationship path is over doesn’t let you know WHAT happened – WHY it happened or WHEN it happened unless you get lucky in your VOC comments. Qualitative data – capturing and documenting what segments are doing/thinking and feeling by touch becomes a valuable asset when you start looking at both MacroCX (Get/Keep/Grow) as well was MicroCX (Communications and UX).

MacroCX – Frequent Flyer Flop

Then Mine

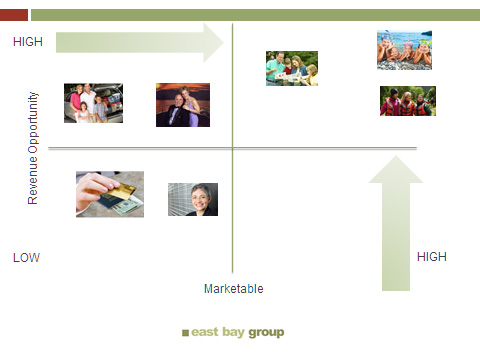

Segmentation by value, needs and behavior provides a view to WHO you should focus on – WHAT they want/need and WHERE you find them. Mapping each of these unique aggregates has lots of use cases.

- Is this our most profitable spend (high value segments please apply here)

- Is this something we can do now or in the future (product and service evaluations)

- What channels are they on and do we support them (Print/Digital/Mobile optimization)

Segments Rated by Marketable Opportunity

IF you have additional quantitative data – say clickstream for digital transactions (Clickfox or Thunderhead) or reason codes from a Call Center or feedback bot – great. Layer those in! Same for observational or interstitial tools like Opinion Labs or Bazaar Voice.

Got a digital marketing tool – add that data in too! Tools like Marketo/Elqoua and Kitewheel can provide interesting data though it needs quite a bit of analysis to determine if there was a Moment of Truth or a Pain point.

Once you have taken the time to bridge the Gap between your VOC and your NPS you can find the actionable intiatives and actions that will drive both Macro- and Micro CX success.

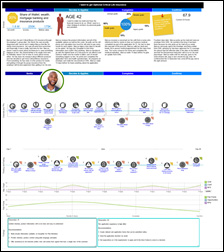

MicroCX Customer Strategy

The ability to add social media analytics, sentiment and observed social monitoring will enable you to shift business strategies, including the challenges of personalization and multichannel influencer projects.

MacroCX Persona Pain Point Management

In terms of customer growth and profitability, each will support brand awareness and customer lifetime value.

Share this Post